“I’m Paying — But My Balance Barely Moves” — The Hidden Pain of Student Loan Interest

How interest quietly keeps student loan borrowers stuck — even after years of payments.

Tiktok failed to load.

Tiktok failed to load.Enable 3rd party cookies or use another browser

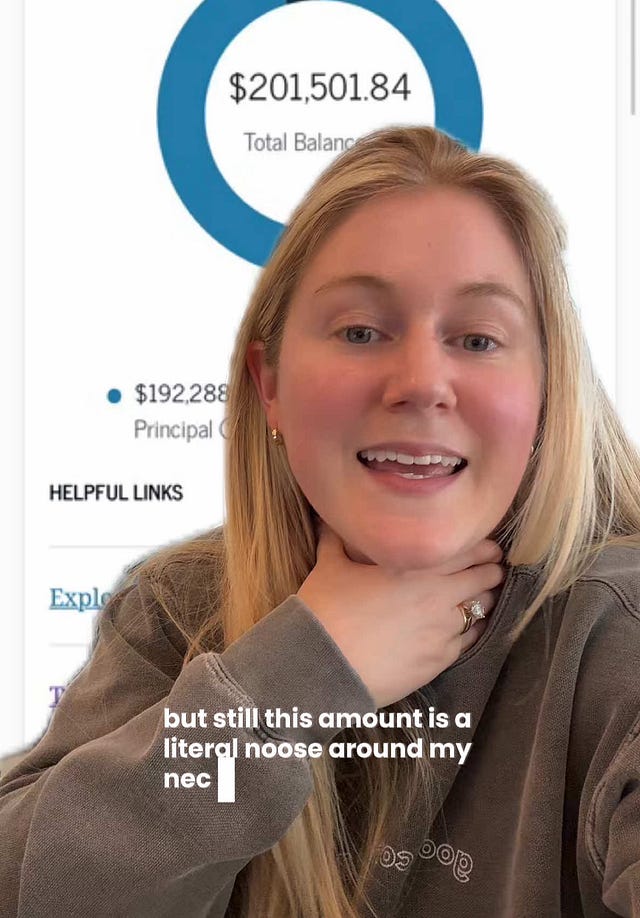

In a recent TikTok posted above, a young professional opens up about something many borrowers know all too well: making regular student loan payments, only to see the balance barely budge.

You can hear the frustration in her voice as she talks about how even after getting the degree, landing a solid job, and making monthly payments, the debt feels almost frozen. The culprit? Interest. And honestly, this is where student loans really sneak up on people.

The Interest Trap Nobody Warns You About

When most of us take out student loans, we focus on the principal — the big number we borrow. But what really drags people down over time isn’t just the amount they borrowed — it’s how interest compounds on top of it.

Let’s say you borrowed $60,000 at 6% interest. That’s $3,600 a year just in interest. If your payments aren’t large enough to cover that — or if you’re on a lower income-based repayment plan — a big chunk of your payment is simply going toward interest, not actually lowering the amount you owe. In some cases, people make payments for years and feel like they’ve barely made a dent because of how much interest keeps accumulating.

It’s like trying to empty a bathtub while the faucet is still running.

Why This Feels So Defeating

This is why so many people who are making responsible payments feel stuck. They’re paying on time, following the rules, but the math makes it feel like they’re standing still. And unlike credit cards or personal loans, student loan terms often stretch 10, 20, even 25 years — which means more time for interest to pile up.

Worse, if someone had loans in deferment or forbearance at any point (during school, after graduation, or because of financial hardship), interest kept accruing — and often capitalized, meaning it got added onto the principal and started generating interest on top of interest.

The Emotional Toll

This isn’t just a math problem. Watching your balance refuse to shrink can wear you down emotionally. It can feel like you’re being punished for trying to build a career or invest in your future. And the longer it drags on, the more it can delay things like buying a house, starting a family, or saving for retirement.

This is exactly what the TikTok captures: that quiet frustration of doing everything “right” and still not seeing progress. It’s a feeling shared across so many careers — whether you're a teacher, nurse, engineer, or therapist.

So What Can You Do?

If you’re stuck in this interest trap, you’re not alone — and you do have options.

First, fully understand how your payments are being applied. Are you covering at least the interest every month? Are you on the best repayment plan for your situation? Income-driven repayment can help with affordability, but sometimes leaves balances growing.

Second, explore whether refinancing could lower your interest rate. That can make a big difference over time — but it’s not for everyone, especially if you’re eligible for programs like Public Service Loan Forgiveness (PSLF).

Finally, if you do qualify for forgiveness programs, make sure you’re fully enrolled, tracking your payments, and keeping records — because those programs can dramatically shorten your repayment timeline if used correctly.

You’re Paying for School Long After You Leave

The TikTok says what a lot of people are thinking but rarely say: “I’m paying and paying, but I still owe almost the same as when I started.” That’s not because borrowers are bad with money. It’s because of how these loans are structured — and how powerful compound interest can work against you when you're the one borrowing.

Talking about it openly helps others feel less isolated and more empowered to explore options, push for better policies, and make informed choices going forward.

Disclaimer: The information provided is not intended to replace professional financial advice tailored to your unique situation. Despite our best efforts to ensure the accuracy and timeliness of the information presented here, we make no express or implied representations or warranties about its completeness, accuracy, reliability, suitability, or availability. Any reliance you place on such information is solely at your own risk. Please be advised that the content herein is not financial advice. It is highly recommended that you seek personalized financial advice from a professional.